Navigating the complexities of obtaining a mortgage can be stressful, especially in a vibrant market like Melbourne. That's where a dedicated mortgage broker comes in. A skilled Melbourne mortgage broker acts as your dedicated guide, streamlining the process and guiding you towards achieving your dream of owning a home goals.

They possess an in-depth understanding of the current lending landscape, leveraging a wide range of mortgage providers to secure the most favorable mortgage solution for your unique situation.

- Pros of partnering with Melbourne Mortgage Broker:

- Save time and effort: They handle the investigation and negotiations on your behalf, freeing up your energy.

- Access to a wider range of lenders: They have networks with multiple lenders, expanding your possibilities of securing the best possible deal.

- Expert guidance and advice: They deliver tailored recommendations based on your goals.

Don't let the mortgage process become a burden. Contact a trustworthy Melbourne mortgage broker today and let them help you towards achieving your property goals.

Obtain Your Dream Home with a Top Melbourne Mortgage Broker

Purchasing your ideal property in Melbourne is a momentous achievement, but navigating the complex world of mortgages can feel overwhelming. That's where a experienced mortgage broker comes in, acting as your dedicated advisor throughout the entire process. A top Melbourne mortgage broker possesses an in-depth familiarity of the current market and offers access to a wide range of loan options from leading lenders.

By partnering with a reputable broker, you can benefit several advantages. Firstly, they will carefully analyze your financial situation and pinpoint the most suitable mortgage solutions tailored to your unique needs. Secondly, they will bargain on your behalf with lenders to achieve the most competitive interest rates and favorable loan terms. Lastly, a top Melbourne mortgage broker will provide continuous support and guidance throughout the entire application and approval stage, ensuring a smooth and stress-free experience.

Get Pre-Approved for a Mortgage in Melbourne Today

Purchasing your dream home within Melbourne is easier than you think. To ensure a smooth and successful home buying journey, getting pre-approved for a mortgage is the crucial first step. A pre-approval reveals lenders how much your budget can handle, giving you a clear understanding of your borrowing power. Furthermore, it puts you in a stronger position when making offers on properties.

Take control by your home buying experience and apply for pre-approval today! Our expert team at [Your Mortgage Company Name] is here to guide you through every step smoothly. Contact us now for a no-obligation consultation.

Exploring the Melbourne Property Market

Unlocking your dream home in Melbourne's dynamic market can feel overwhelming. Whether you're a savvy prospective homeowner or a seller, expert guidance is essential to ensure a smooth and favorable outcome. At [Company Name], our team of dedicated mortgage advisors are committed to providing personalized solutions tailored to your unique requirements.

Utilizing our in-depth knowledge of the local market and industry trends, we'll help you comprehend complex financing options, acquire competitive interest terms, and streamline the entire mortgage process. Our experts are passionate about empowering homeowners with the tools and knowledge they need to make wise decisions about their property investments.

Let us be your trusted advocate in achieving your Melbourne property aspirations. Speak with us today for a free consultation and let's begin developing your path to homeownership.

Compare Mortgage Rates and Discover the Best Deal in Melbourne

Purchasing a property in Melbourne is an exciting endeavor, but navigating the world of mortgages can feel overwhelming. With numerous lenders offering a variety of rates and terms, finding the perfect deal requires careful research.

Start by comparing mortgage rates from diverse lenders. Online comparison tools can be a valuable resource for this process, allowing you to quickly and easily see the interest rates and terms offered by different institutions.

Don't just focus on the starting rate; consider the overall expense of the loan over its lifetime. Elements such as fees, repayment terms, and variable interest rates can significantly impact your economic prospects.

- Consult a mortgage broker to get personalized suggestions. They have access to a wide range of lenders and knowledge in the regional market.

- Negotiate with lenders to try to secure the best possible terms. Be prepared to present your financial status clearly and convincingly.

By taking more info the time to investigate your options and contrast different mortgage rates, you can secure a loan that meets your economic needs.

Optimize Your Mortgage Application Process in Melbourne

Purchasing a home in Melbourne is an exciting achievement, but the mortgage application process can sometimes feel overwhelming. Don't let complexities stand in your way! By following these guidelines, you can seamlessly navigate the process and get closer to your dream home faster. First, meticulously review your financial situation and assess how much you can afford. Next, research different mortgage lenders and evaluate their financing options. Don't hesitate to consult a mortgage broker who can provide expert advice and guide you through the application. By taking these proactive steps, you can reduce the time it takes to secure your mortgage approval.

Remember, a well-prepared application is crucial for a positive outcome.

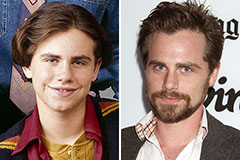

Rider Strong Then & Now!

Rider Strong Then & Now! Kelly Le Brock Then & Now!

Kelly Le Brock Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!